By Timothy W. Martin

Click here to view the full article

Herbert Whitehouse was one of the first in the U.S. to suggest workers use a 401(k). His hope in 1981 was that the retirement-savings plan would supplement a company pension that guaranteed payouts for life.

Thirty-five years later, the former Johnson & Johnson human-resources executive has misgivings about what he helped start.

What Mr. Whitehouse and other proponents didn’t anticipate was that the tax-deferred savings tool would largely replace pensions as big employers looked for ways to cut expenses. Just 13% of all private-sector workers have a traditional pension, compared with 38% in 1979.

“We weren’t social visionaries,” Mr. Whitehouse says.

Many early backers of the 401(k) now say they have regrets about how their creation turned out despite its emergence as the dominant way most Americans save. Some say it wasn’t designed to be a primary retirement tool and acknowledge they used forecasts that were too optimistic to sell the plan in its early days.

Others say the proliferation of 401(k) plans has exposed workers to big drops in the stock market and high fees from Wall Street money managers while making it easier for companies to shed guaranteed retiree payouts.

“The great lie is that the 401(k) was capable of replacing the old system of pensions,” says former American Society of Pension Actuaries head Gerald Facciani, who helped turn back a 1986 Reagan administration push to kill the 401(k). “It was oversold.”

Misgivings about 401(k) plans are part of a larger debate over how best to boost the savings of all Americans. Some early 401(k) backers are now calling for changes that either force employees to save more or require companies to funnel additional money into their workers’ retirement plans. Current regulations provide incentives to set up voluntary plans but don’t require employees or companies to take any specific action.

A 401(k) is an employer-sponsored plan that allows workers to place pretax wages into a savings account. Companies aren’t required to make matching contributions, but they often do as an employee perk. Unlike defined-benefit pensions, which provide set payouts for life, 401(k) accounts rise and fall with financial markets.

The advent of 401(k)s gave individuals considerable discretion as to how and even whether they would save for retirement. Just 61% of eligible workers are currently saving, and most have never calculated how much they would need to retire comfortably, according to the Employee Benefit Research Institute and market researcher Greenwald & Associates.

Financial experts recommend people amass at least eight times their annual salary to retire. All income levels are falling short. For people ages 50 to 64, the bottom half of earners have a median income of $32,000 and retirement assets of $25,000, according to an analysis of federal data by the New School’s Schwartz Center for Economic Policy Analysis in New York. The middle 40% earn $97,000 and have saved $121,000, while the top 10% make $251,000 and have $450,000 socked away.

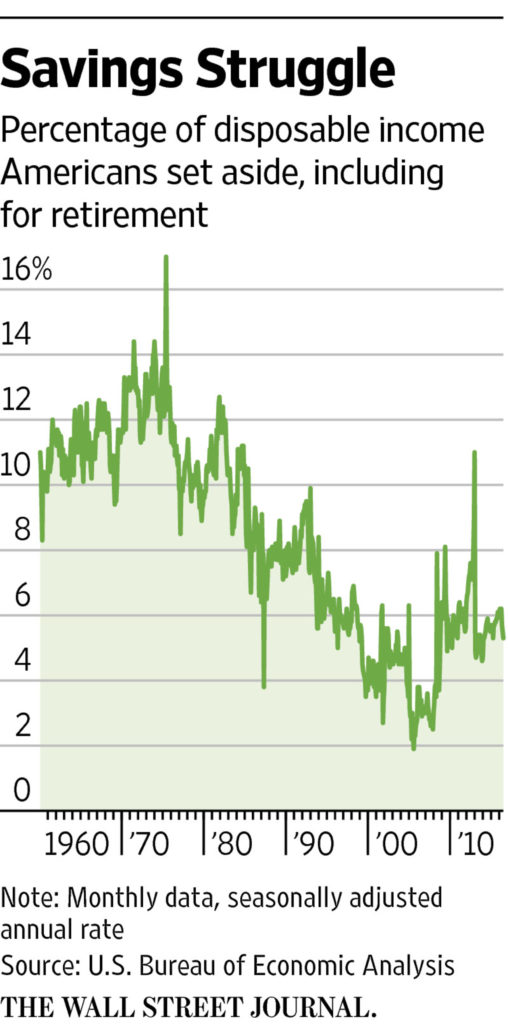

And the savings gap is worsening. Fifty-two percent of U.S. households are at risk of running low on money during retirement, based on projections of assets, home prices, debt levels and Social Security income, according to Boston College’s Center for Retirement Research. That is up from 31% of households in 1983. Roughly 45% of all households currently have zero saved for retirement, according to the National Institute on Retirement Security.

More than 30 million U.S. workers don’t have access to any retirement plan because many small businesses don’t provide one. People are living longer than they did in the 1980s, fewer companies are covering retirees’ health-care expenses, wages have largely stagnated and low interest rates have diluted investment gains.

“I go around the country. The thing that people are terrified about is running out of money,” says Phyllis C. Borzi, a U.S. Labor Department assistant secretary and retirement-income expert.

Some savers underestimate how much they will need to retire or accumulate too much debt. Lucian J. Bernard is among those wishing he had a do-over. The 65-year-old lawyer from Edgewood, Ky., doesn’t have much savings beyond a small company pension and Social Security. He cashed out a 401(k) in the 1980s to fund law school and never replenished it. He implores his daughter to start saving.

“It’s a little easier saying it than doing it,” he says.

Defenders of the 401(k) say it can produce an ample retirement cache if employers provide access to one and people start saving early enough. People in their 60s who have been socking away money in 401(k)s for multiple decades have average savings of $304,000, according to the Employee Benefit Research Institute and Investment Company Institute.

“There’s no question it worked” for those who committed to saving, says Robert Reynolds, who was involved in Fidelity Investments’ first sales of 401(k) products several decades ago.

He considers himself among the success stories. At 64, he could retire comfortably today after saving for three decades. “It’s a very simple formula,” he says. “If you save at 10% plus a year and participate in your plan, you will have more than 100% of your annual income for retirement.”

The 401(k) can be traced back to a 1978 decision by Congress to change the tax code—at line 401(k)—so top executives had a tax-free way to defer compensation from bonuses or stock options.

At the time, defined benefit-pension plans, which boomed in popularity after World War II, were the most common way workers saved for retirement.

Ted Benna, a retired benefits consultant, is sometimes called the father of the 401(k). He now thinks it gives individual savers too many opportunities to make mistakes. PHOTO: WILL YURMAN FOR THE WALL STREET JOURNAL

A group of human-resources executives, consultants, economists and policy experts then jumped on the tax code as a way to encourage saving. Ted Benna, a benefits consultant with the Johnson Companies, was one of the first to propose such a move, in 1980, leading some in the industry to refer to him as the father of the 401(k).

Selling it to workers was a challenge. Employees could put aside money tax-free, but they were largely responsible for their own saving and investment choices, meaning they could profit or lose big based on markets. They also took home less money with each paycheck, which is why 401(k)s were commonly called “salary reduction plans.”

Traditional pension plans, on the other hand, had weaknesses: Company bankruptcies could wipe them out or weaken them, and it was difficult for workers to transfer them if they switched employers.

Companies embraced the 401(k) because it was less expensive and more predictable to fund than pensions. Company pay-ins ended when an employee left or retired.

Employees, for their part, were drawn to an option that could provide more than a company’s pension ever would. Two bull-market runs in the 1980s and 1990s pushed 401(k) accounts higher.

Economist Teresa Ghilarducci, director of the Schwartz Center for Economic Policy Analysis, says she offered assurances at union board meetings and congressional hearings that employees would have enough to retire if they set aside just 3% of their paychecks in a 401(k). That assumed investments would rise by 7% a year.

“There was a complete overreaction of excitement and wow,” says Kevin Crain, who as a young executive at Fidelity Investments in the 1990s recalled complaints about some of its funds underperforming the S&P 500. “People were thinking: Forget that boring pension plan.”

Two recessions in the 2000s erased those gains and prompted second thoughts from some early 401(k) champions. Markets have since recovered, but many savers are still behind where they need to be.

Ms. Ghilarducci says she came to realize the 401(k) math she used in the 1980s and 1990s no longer works. The 7% annual compounded investing returns, a pillar of the concept, now seems too rosy. She now believes setting aside 3% of salary isn’t enough.

The downturns showed Mr. Benna of Johnson Companies that individual savers have too many opportunities to make mistakes, such as yanking money out during market downturns or selecting unsuitable investment mixes for their ages. He also notes that money managers can charge fees that eat away at savings.

“I helped open the door for Wall Street to make even more money than they were already making,” he says. “That is one thing I do regret.” Mr. Benna retired at age 49 after selling his consulting firm in 1990. He doubts “any system currently in existence” will be effectual for the majority of Americans.

There have been several attempts to make the 401(k) more effective by changing the behavior of savers and companies.

A 2006 U.S. law made it easier for companies to enroll workers automatically in 401(k) plans. Some firms then raised workers’ default contributions by 1 percentage point a year until they hit a cap as a way of encouraging more savings.

Participation levels have improved, but about one-third of workers traditionally refuse to join their company’s 401(k) plans despite perks such as employer-matching contributions.

The Obama administration made a push to get people to save more for retirement, even outside the realm of the 401(k). It introduced a regulation that encourages states to set up retirement savings plans with automatic enrollment features for private-sector employees. The Labor Department has unveiled a proposal to enable large cities to create similar plans.

Opponents have said such plans crowd out competition from the private sector, and Congress blocked the Obama administration’s attempts to create similar plans at the federal level.

Eight states, including Illinois, Massachusetts and California, have plans to set up their own programs for the uncovered that will offer guaranteed returns and provide incentives for small businesses to create accounts for people who don’t have them. Dozens more are exploring the idea.

Some initial believers in the 401(k) think those measures don’t go far enough. Ms. Ghilarducci wants to ditch the 401(k) altogether. She and Blackstone Group President Tony James are recommending a mandated, government-run savings system that would be administered by the Social Security Administration and managed by investment professionals. While both are Democrats, they believe their solution has bipartisan appeal.

“There are a lot of governors and mayors who are Republicans, and the first wave of the crisis will affect states and cities,” Ms. Ghilarducci says.

She says she has already reached out to President-elect Donald Trump’s advisers to float the plan.

Others are calling for a national mandate on savings or requiring companies to automatically enroll participants at 6% of pay. Sen. Marco Rubio, the Florida Republican, has proposed opening up the federal government’s Thrift Savings Plan, the 401(k)-style plan for federal employees, to private-sector workers.

Some early 401(k) supporters are learning about its shortcomings firsthand. Mr. Whitehouse, the former Johnson & Johnson human-resources executive, says his 401(k) took a hit after 2008. He could retire if he had to, but if he wants to maintain his standard of living for several more decades, he must continue to work, he says.

The 65-year-old currently lives in Orlando and is in-house counsel for ABC Fine Wine & Spirits, a Florida chain with about 140 stores. He plans to work into his mid-70s.

It would be appealing, he says, to have an old-fashioned pension. “A pension is pretty valuable,” he says.

Appeared in the January 3, 2017, print edition as ‘401(k) Pioneers Lament What They Started.’