Editorial by Tom Eblen

Click here to view the full article

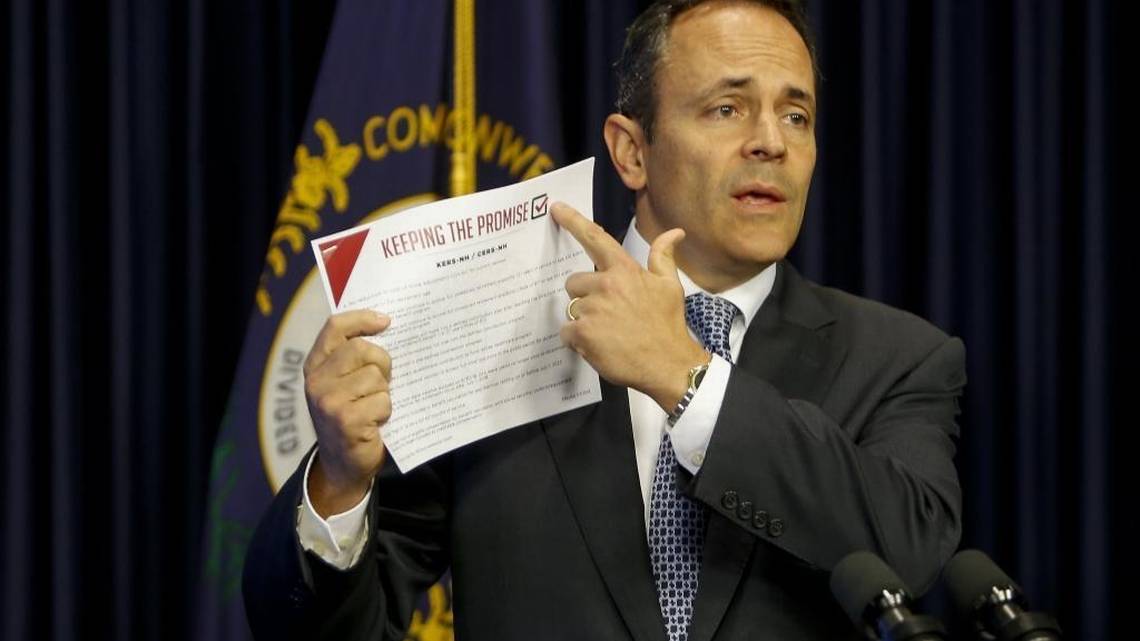

Kentucky Gov. Matt Bevin unveiled his plan to overhaul Kentucky’s public pension systems during a news conference Oct. 18 at the state Capitol. Michael Reaves

Corporations have spent four decades taking traditional pensions away from most American workers. Now they and their allies want to do the same to school teachers and other public employees.

Kentuckians recently got a reminder that efforts to replace public employees’ defined-benefit pensions with 401k-style defined-contribution plans are more about ideology than finance and are part of a national campaign by conservative activists.

Many members of the General Assembly were rightfully irritated when they were emailed a demand letter organized by the Pegasus Institute, a conservative think tank in Louisville.

In order to protect taxpayers, the letter said, pension risk must be shifted to employees, “which can only be done by embracing the same structural reforms that were adopted by the private sector decades ago, moving all future employees from a defined-benefits system to a defined contributions system.”

The letter was signed by several Kentucky business executives, Republican leaders and donors and Grover Norquist, an anti-government activist in Massachusetts who has bullied politicians for years to sign pledges against ever raising taxes.

“I don’t want to abolish government,” Norquist famously said in a 2001 interview. “I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub.”

Norquist and his ilk are one reason Kentucky’s pensions are so under-funded.

Some pension problems were caused by high-risk investments made with little transparency and the 2008 financial collapse caused by Wall Street’s shenanigans. But the biggest issue is that Kentucky politicians short-changed pension contributions for years because they had to balance the state budget and were afraid to raise taxes — in part because of pressure from the Norquist crowd.

Having created this crisis, anti-tax politicians are now being pressured to solve it on the backs of public employees and retirees. Kentucky state employees except teachers hired since 2014 are already in hybrid plans. But conservative activists want more.

So-called 401k’s were created in the early 1970s so highly paid executives could put some of their income into tax-deferred retirement investments. These funds were never meant to replace traditional pensions. But businesses began doing that because it saved them money and shifted the risk to employees, whose retirement security was left to the vagaries of Wall Street.

Kentucky Senate President Robert Stivers offered reporters Tuesday, Feb. 13, 2018, some information about a major public pension bill expected to be unveiled this week. jbrammer@herald-leader.com

Defined-contribution plans have some advantages, such as portability as people change jobs.But experts warn that many plan participants will end up with too little money for a secure retirement. That is especially troubling because of efforts by Republicans in Congress to undermine Social Security and Medicare.

Right-wing front groups and think tanks have been promoting this policy for years. They include the billionaire Koch brothers’ Americans for Prosperity and the many public policy groups they and their allies fund, such as Michigan’s Mackinac Center and the Bluegrass Institute for Public Policy Solutions. They also include the ultra-conservative American Legislative Exchange Council and the Pew Charitable Trusts, which got funding frombillionaire John Arnold.

But in states that have made the switch, things haven’t gone well for either employees or taxpayers. It was such a disaster in West Virginia that teachers switched back to their old pension system.

Gov. Matt Bevin started beating this drum last fall, hyping Kentucky’s long-term pension liabilities as a “crisis” that had to be solved quickly. He has paid a consulting firm $1.25 million to try to make the case. And he has been backed by a shadowy Republican-linked group called Save Our Pensions, which launched a campaign to scare taxpayers into supporting the switch.

But the numbers have not added up. That’s the likely reason we are a month into the legislative session and GOP lawmakers have yet to unveil their secret pension bill. Studies by the Kentucky Center for Economic Policy also have shown that defined-contribution plans would cost taxpayers more while degrading pension benefits. It has recommended better approaches.

Republican lawmakers say their pension bill will be unveiled this week, and they have hinted at what it may contain. They also have rejected a proposal by Rep. James Kay, D-Versailles, that would raise $600 million for pension funding, saying more than tax increases are needed.

Despite the political firestorm these Republican proposals have created in Kentucky, the General Assembly’s majority party seems determined to change the pension system and not just properly fund it. But as ideology clashes with reality, their biggest enemy may turn out to be math.