When social security was being established, Kentucky had already established TRS to fund the retirements of Kentucky's retired educators. Enrolling Ky's teachers into social security would have caused a significant drop in the income teachers would receive after deductions. So, since the teachers already had a retirement system the decision was made to not enroll teachers in the social security system meaning, while teaching, teachers do not pay into social security nor receive benefit payouts from the system.

This is significant because it means that the retirement benefits paid out by TRS are the only safety net available to people who have spent their whole life teaching. If their benefits from TRS cease, they would be totally reliant on personal savings or other income.

Collecting social security benefits goes further than this though. In the case that a retired teacher's spouse dies, the surviving retiree would not be able to collect the spouse's social security income like other Americans.

There are some caveats. If a teacher works a sufficient amount of time outside of the classroom they could collect some social security benefits from the work done during that time, however that payout amount is reduced. But, for the most part, Kentucky's retired career teachers do not collect social security, and are totally reliant upon the income from their pension benefits and personal savings to sustain a living after retirement.

A case study written from 2018 tracked the town of Palm Beach, Florida after making a switch from a DB pension plan to a 401(k)-style Defined Contribution (DC) pension plans for public safety workers in 2012.

• After the switch Palm Beach experienced an exodus of more than 100 public-safety workers, such as police and firefighters, in the span of only four years.

• The town was so impacted by the exodus, and the financial strain that arose from recruiting and retraining new replacement workers, that in 2016 the town voted to change their decision and return the workers to a DB pension plan.

• Read the full case study at this link:

https://teachfrankfort.org/new-case-study-examines-dismantling-pensions-triggered-mass-exodus-public-safety-workers/

In another study that evaluated teacher pensions versus 401(k) style plans in Connecticut, Colorado, Georgia, Kentucky, Missouri, and Texas commissioned by National Institute on Retirement Security and performed by University of California at Berkeley there were several important findings:

• As teacher shortages worsen, policymakers should understand that pensions exert a clear retention effect on teachers. Retaining experienced teachers lowers teacher turnover, eases schools' staffing pressures, and contributes to education quality.

• Shifting from pensions to 401(k)s or other account-based plans significantly reduces the retirement incomes of long-term teachers who conduct most classroom teaching and is likely to increase turnover among experienced teachers.

• While potentially benefiting short-service teachers, shifting to 401(k)s will decrease the pre-retirement and/or the post-retirement income of teachers. This is because teachers will have to reduce their current consumer spending if they save more funds from their pay to preserve their level of retirement income and/or reduce their future consumer spending when they retire in the state with lower benefits.

Traditional pension plans are a great retirement solution for millions of Americans and are a sustainable financial model if an employer contributes the required amounts to the plan and makes proper actuarial assumptions. Unfortunately, since 2007, instead of contributing to the Teachers' Retirement System (TRS), our state government has essentially borrowed billions of dollars that it pledged to our teachers to fulfill their spending priorities with other special interests. Because Frankfort has not contributed requested amounts to the TRS from 2007 - 2016, teachers have not only missed out on the principal that is owed to them, but also the billions of dollars in compounded interest to which they should be entitled. After all, in 2004, the TRS was more than 90 percent funded. Now, it's only 56 percent funded and $15-20 billion in debt.

Even the PFM Consulting Group report stated the primary reason for the TRS’ lack of funding is related to poor actuarial assumptions and the lack of contributions by state government. Life expectancy and the total amount of teachers who both retired and actively teaching, on the other hand, have not changed much since 2004.

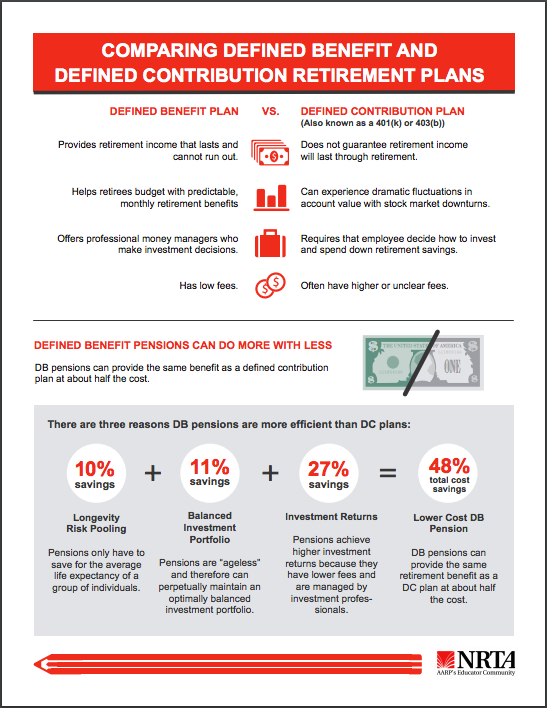

Wall Street is the only winner when converting to a defined contribution plan. 401(k) style plans carry much higher both to administer, and also higher fees on individual mutual fund offerings for teachers.

Traditional defined benefit plans (current plan) are more efficient due to economies of scale, risk pooling, and other factors. Changing plan types introduces significant transition costs. States that switched to defined contribution plans did not save money except to the extent that they cut benefits or required workers to contribute more to their retirement.

Click the image below to view full infographic (+)

The PFM recommendations suggest that 401(k)-style defined-contribution plans are common in the private sector and that teachers should be required to use the same sort of plan.

Professionals in the public sector with a master’s degree make on average approximately 60 percent less per year than private-sector professionals with similar educational backgrounds. In addition, many private sector professionals have much richer benefits than teachers including but not limited to:

• Tuition reimbursement

• Profit-sharing plans

• Stock-option plans

• Discounted stock purchase plans

• Company vehicles

• Flexible hours

• Deferred compensation plans

Private-sector employees participate in and receive benefits from the federal Social Security retirement system. Kentucky teachers are not eligible for Social-Security retirement benefits because of their participation in TRS.

While it is true the private sector employees are used to 401(k)-style retirement plans, they also have access to a tremendous amount of benefits that are not offered in the teaching profession.

Many teachers are passionate about working with children and choose the profession knowing that if they put in a significant amount of time and effort educating Kentucky’s youth, they will be taken care of with a modest, yet dignified retirement when their teaching days are over.

Making a transition from a defined-benefit plan to a defined-contribution fund means new hires will not be paying into the existing pension fund (which will continue for those teachers who have already retired) and more government resources will be spent for employer matches under the defined-contribution plan. This will result in further fund instability and exacerbate the financial issues facing our existing public pensions. Other states that have tried to address pension underfunding by converting to a defined-contribution plans have seen dismal fiscal results.

For example:

Since 1985 investment income totaled $26.5 billion while benefit payments and refunds totaled $28.7 billion. The percentage of investment income to benefit payments then is 92.33%. If administrative expenses are included at $0.2 billion with benefit payments, the percentage covered by investment income then shifts to 92.7%.

Based on TRS' 30-year historical investment performance, each time the legislature fails to make a $1.00 in capital contribution to the pension fund, TRS misses out on an additional $1.00 in investment income over the next ten years. Less money contributed equates to less money in investment income.

TRS is nationally recognized for its risk and administrative management and has consistently ranked in the top five percent of the United States for its investment returns. TRS has averaged more than 8 percent return on investment over the past 30 years.

TRS has maintained a well-balanced conservative investment portfolio. TRS has never invested in hedge funds, subprime mortgages, or allowed or used placement agents for investments.

The TRS actuary has stated that as long as full funding continues, there will be sufficient money available to pay the promised benefits to Kentucky's Retired Teachers.

https://teachfrankfort.org/teachers-retirement-system-fact-sheet/

How can you help?

Send a pre-written message to your local officials using the form below.

Are you a retired teacher who now lives outside the Commonwealth of Kentucky? click here

For any additional questions or concerns, contact info@teachfrankfort.org.

problems viewing form? click here

need instructions? click here